Other questions asked by students

Q

QUESTION 24 The left side of the heart receives oxygenated blood from the lungs and pumps blood...

Medical Sciences

Accounting

Q

Xavier and Santos formed a 50/50 partnership. Xavier provided equipment which had a fair market...

Accounting

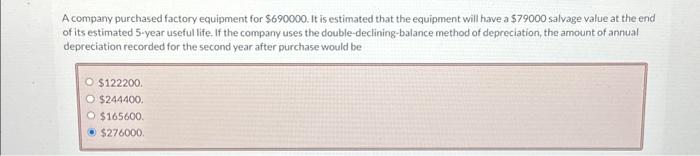

Accounting

Accounting