Other questions asked by students

Q

Climate change is a daunting problem facing humanity today. One way to mitigate this problem in...

Civil Engineering

Statistics

Biology

Q

Which features are synapomorphies of primates Select all that apply they have grasping hands they...

Biology

Calculus

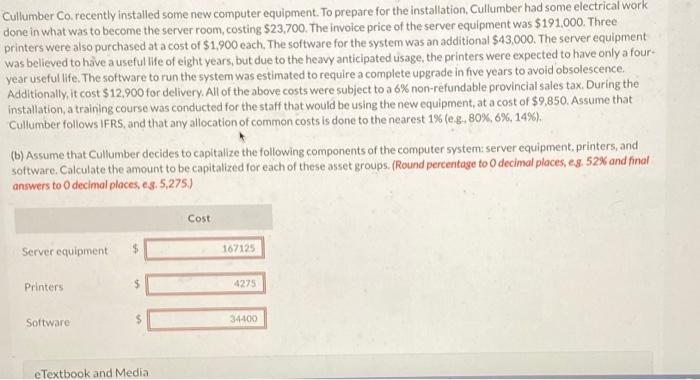

Accounting