Other questions asked by students

Physics

General Management

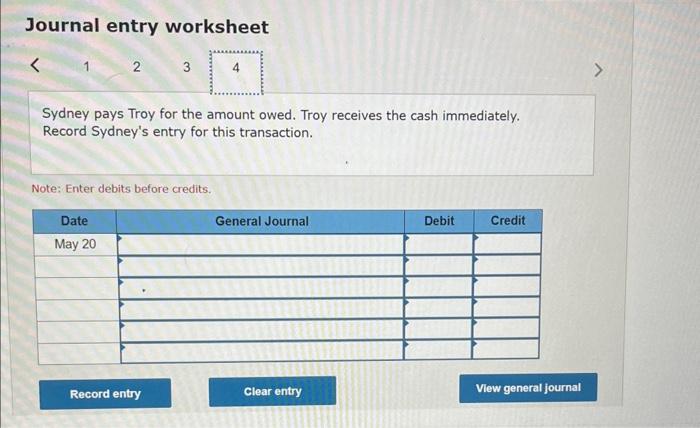

Accounting

Accounting

Accounting