Other questions asked by students

Operations Management

Statistics

Accounting

Accounting

Accounting

Accounting

Accounting

Accounting

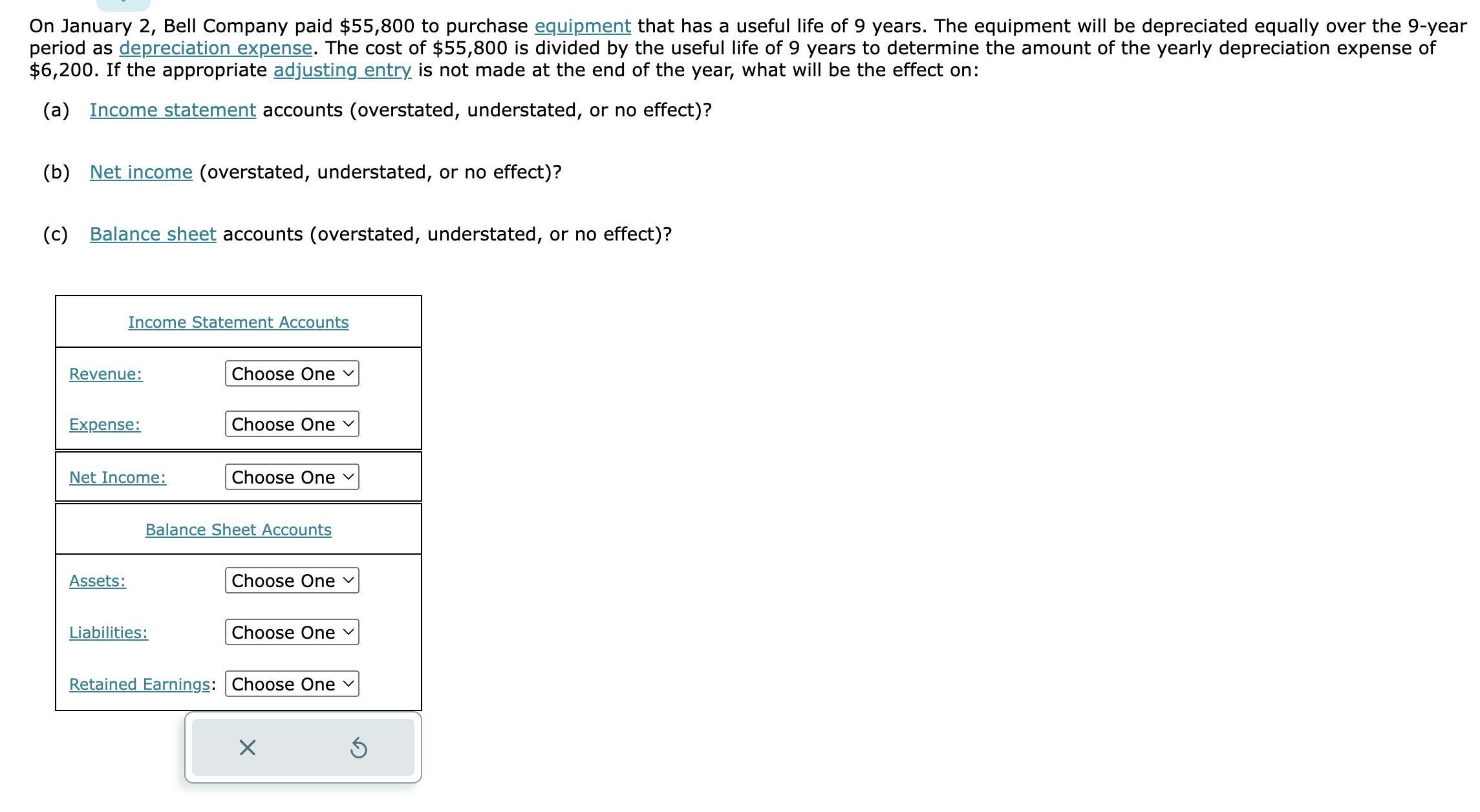

On January 2, Bell Company paid $55,800 to purchase equipment that has a useful life of 9 years. The equipment will be depreciated equally over the 9 -year period as depreciation expense. The cost of $55,800 is divided by the useful life of 9 years to determine the amount of the yearly depreciation expense of $6,200. If the appropriate adjusting_entry is not made at the end of the year, what will be the effect on: (a) Income statement accounts (overstated, understated, or no effect)? (b) Net income (overstated, understated, or no effect)? (c) Balance sheet accounts (overstated, understated, or no effect)

On January 2, Bell Company paid $55,800 to purchase equipment that has a useful life of 9 years. The equipment will be depreciated equally over the 9 -year period as depreciation expense. The cost of $55,800 is divided by the useful life of 9 years to determine the amount of the yearly depreciation expense of $6,200. If the appropriate adjusting_entry is not made at the end of the year, what will be the effect on: (a) Income statement accounts (overstated, understated, or no effect)? (b) Net income (overstated, understated, or no effect)? (c) Balance sheet accounts (overstated, understated, or no effect)