Other questions asked by students

Psychology

Q

Consider the following autonomous DE.y' = 4(y - 1)^2(y - 3)Choose all correct answers.There are...

Algebra

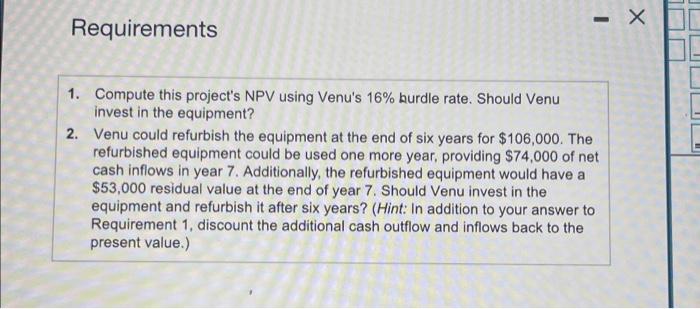

Accounting

Accounting

Accounting

Accounting