Other questions asked by students

Finance

Biology

Q

Find equations for the vertical asymptotes if any for the following rational function Answer How...

Algebra

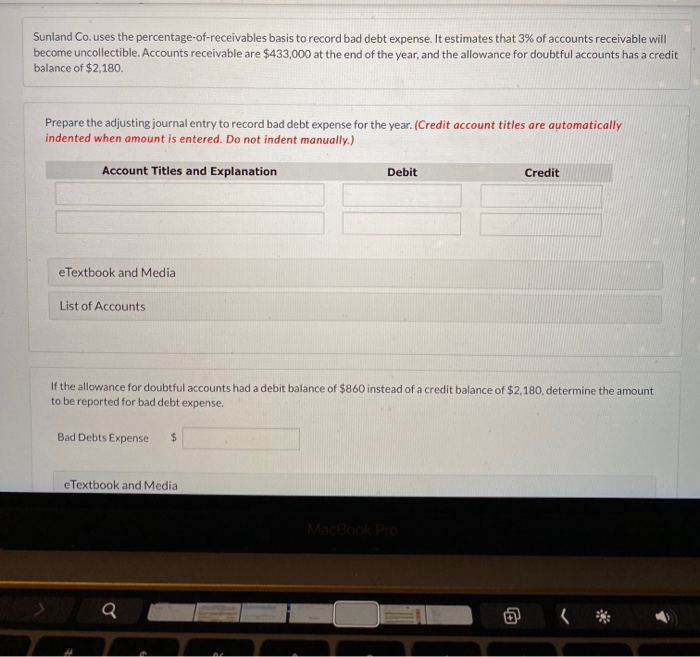

Accounting