Other questions asked by students

Q

Suppose a company has two mutually exclusive projects, both of which are three years in length....

Finance

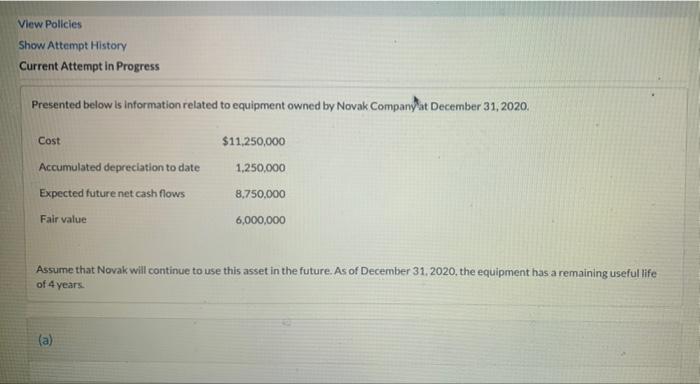

Accounting

Accounting

Accounting

Accounting